Fund Overview Guide

Are you seeking stock market growth but concerned about getting caught in crashing waves during market downturns?

Download the full Fund Overview Guide to see how OHFGX can help you ride the waves of growth and opportunity while staying prepared for market volatility.

Discover OHFGX

Oak Harvest’s OHFGX is structured for the possibility to ride the waves of growth and opportunity and to help you navigate through rougher waters.

Would you like the potential to:

OHFGX’s Alternative Equity Strategy

A key differentiator of OFHGX is its risk management strategy and its implementation. This serves to help preserve investment capital and gain exposure to the market’s ups and defend against its downs.

Riding the Growing Waves While Managing Risk Against Storms

While OHFGX is primarily a growth fund seeking total return, downside opportunities within the portfolio are also a focus. Uniquely, the funds risk management and hedging program is structured so investors can ride the waves of opportunity while preparing for unpredictable market swells. This is similar to a surfer using protective gear to stay afloat when the waves get rough, allowing an investor to get invested and stay invested.

Dynamic and Capital-Efficient Hedging

Like surfers adapt their techniques based on changing wave conditions, OHFGX adjusts its risk-management strategies based on current and future market outlook. The fund managers consider the most efficient use of capital.

Shorting and Using Options to Protect the Portfolio

Shorting stocks is like a surfer dodging a dangerous wave. It allows OHFGX to profit from stocks that may not perform well. This technique can lower overall fund volatility, helping to provide flexibility. Like a surfer passing on a dangerous wave and letting their competition surf it first, it helps increase stability and provides the flexibility to manage risk, enhance potential returns, and stay ahead of market changes.

Process-Driven Investment Approach

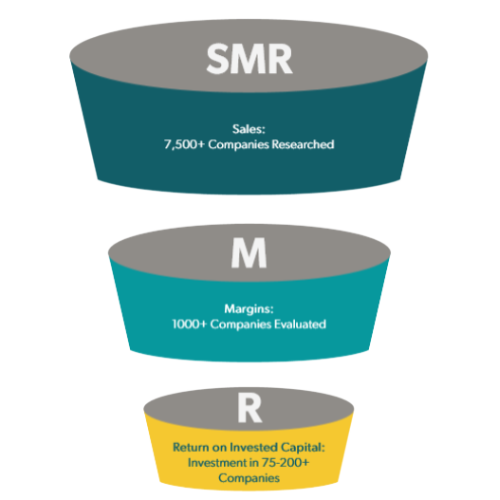

OHFGX uses a process-driven strategy to find high-growth opportunities. The team applies a Sales, Margins, and Return (SMR) approach, using advanced data tools to identify stocks that may perform well in both rising and falling markets. The investment team uses a methodical and repeatable approach to building the portfolio.

SMR Focus – Tuning into the Market’s Signals

Just as surfers use weather patterns to understand the waves, OHFGX’s SMR strategy helps identify stocks best positioned to take advantage of market opportunities, whether rising or falling.

With more than 7,500 U.S.-listed stocks, the investment team leverages proprietary, in-house-developed data extraction, compilation, and analysis tools. The team then identifies the highest-ranked companies for further evaluation and traditional fundamental research.

In addition to being an active growth equity fund, OHFGX uses a combination of alternative equity strategies. This sets the fund apart from a typical mutual fund offered to the general public and makes it more on par with professionally managed hedge funds typically available to wealthy investors.

Experienced Investment Team with Top-Level Partnerships

Established in 2015, Oak Harvest Investment Services manages nearly $1 billion in client assets.

The OHFGX investment team:

- Is a full, in-house, independent portfolio management team that uses data-driven research and trading strategies to build the OHFGX fund

- Has over 30 years of institutional experience in long/short equities. These skilled investment professionals lead our team:

- Chris Perras, CFA – 14 years, including managing short equity funds for Citadel, DG Capital Management, and AIM Investments (now Invesco)

- Charles Scavone, CFA – 11 years, including managing long/short equity funds for Rock Ridge Capital and AIM Investments (now Invesco)

- Dwane Bacak, CFA – 5 years, including working for Invesco as a Trading, Quantitative, and Equity Analyst

- James McFarland – 10 years, including leading derivatives teams for Morgan Stanley and Nissan Securities, and building out the Investment Division at Oak Harvest Investment Services

- Chris Myrick – Investment analyst and trader supporting investment operations and management

- Works with top-level partners Charles Schwab, Ultimus Fund Solutions, Pershing Brokerage, Brown Brother Herriman Bank

Fund Overview Guide

Download the full Fund Overview Guide to see how OHFGX can help you ride the waves of growth and opportunity while staying prepared for market volatility.